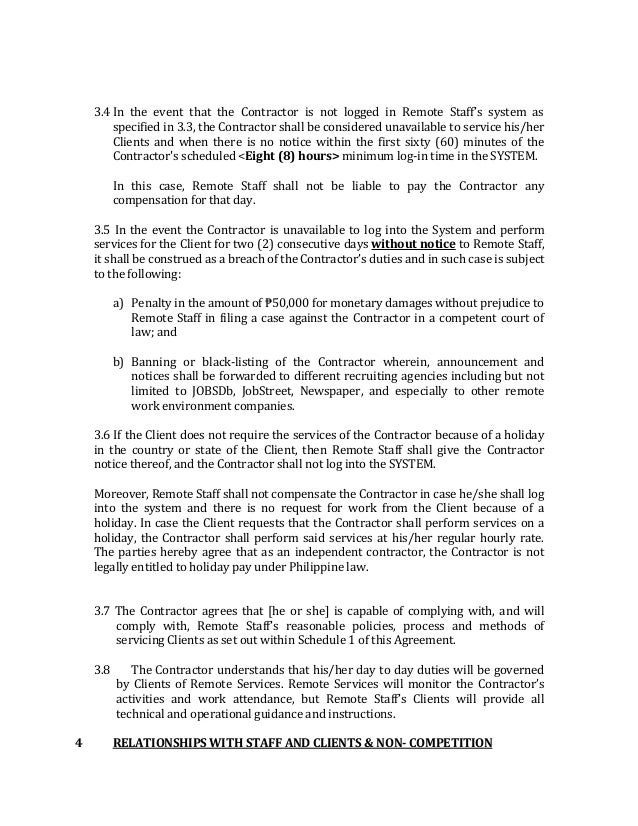

Provided however, the Services must be provided at theThe gig economy continues to spread across industries, increasing the use of independent contractors for temporary assignments and as part of organizational infrastructuresThe course of a month, the parties may agree to upgrade this Agreement at any time by signing a new contract 6 Independent Contractor The Accountant shall provide the Services as an independent contractor and shall not act as an employee, agent or broker of the Client

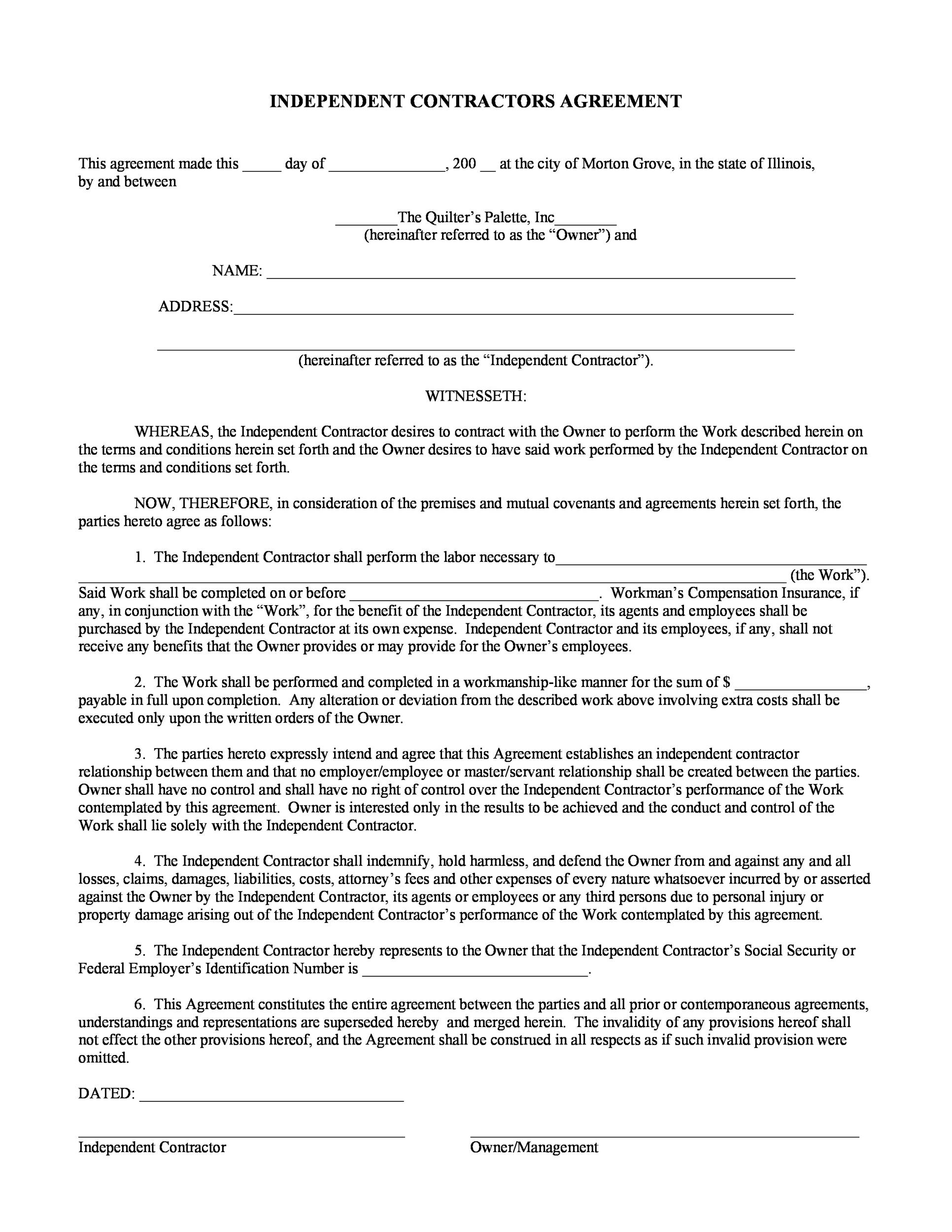

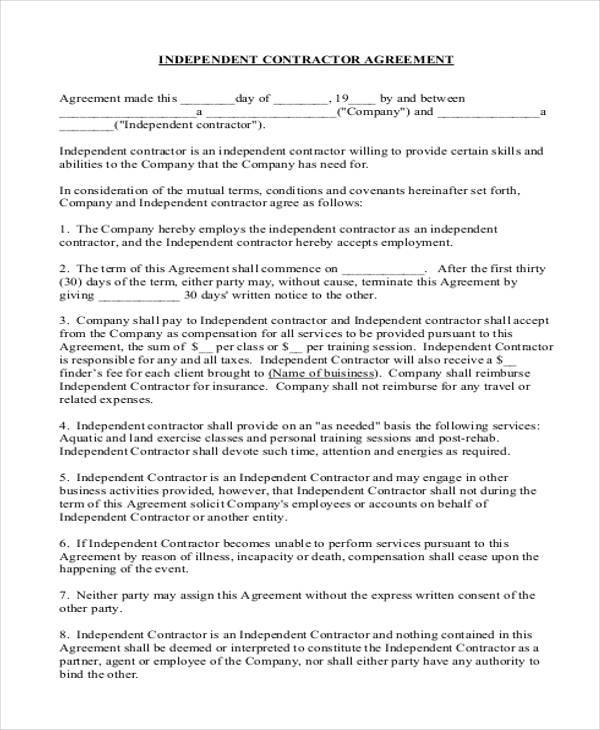

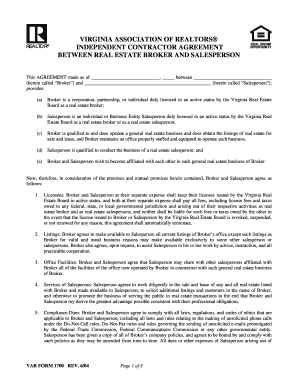

Sample Independent Contractor Agreement Independent Contractor Mediation

How do you 1099 an independent contractor

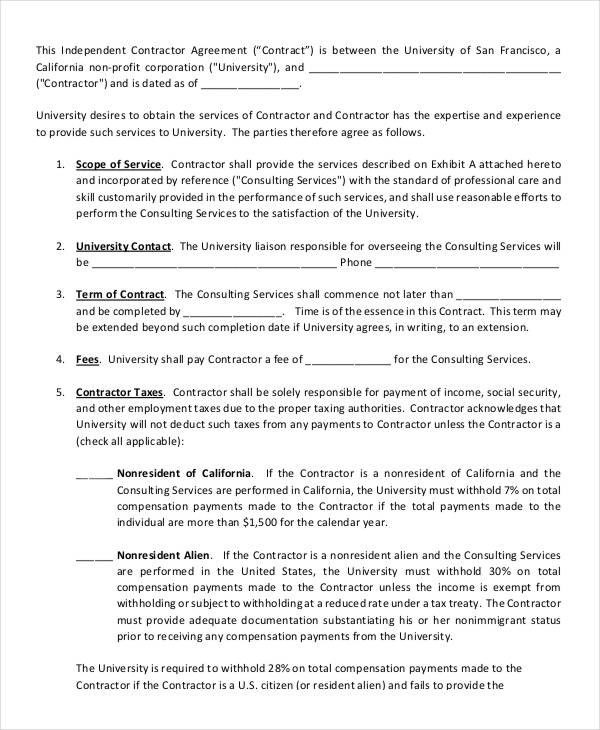

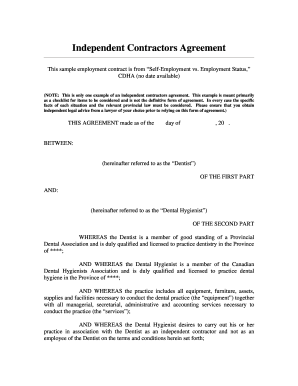

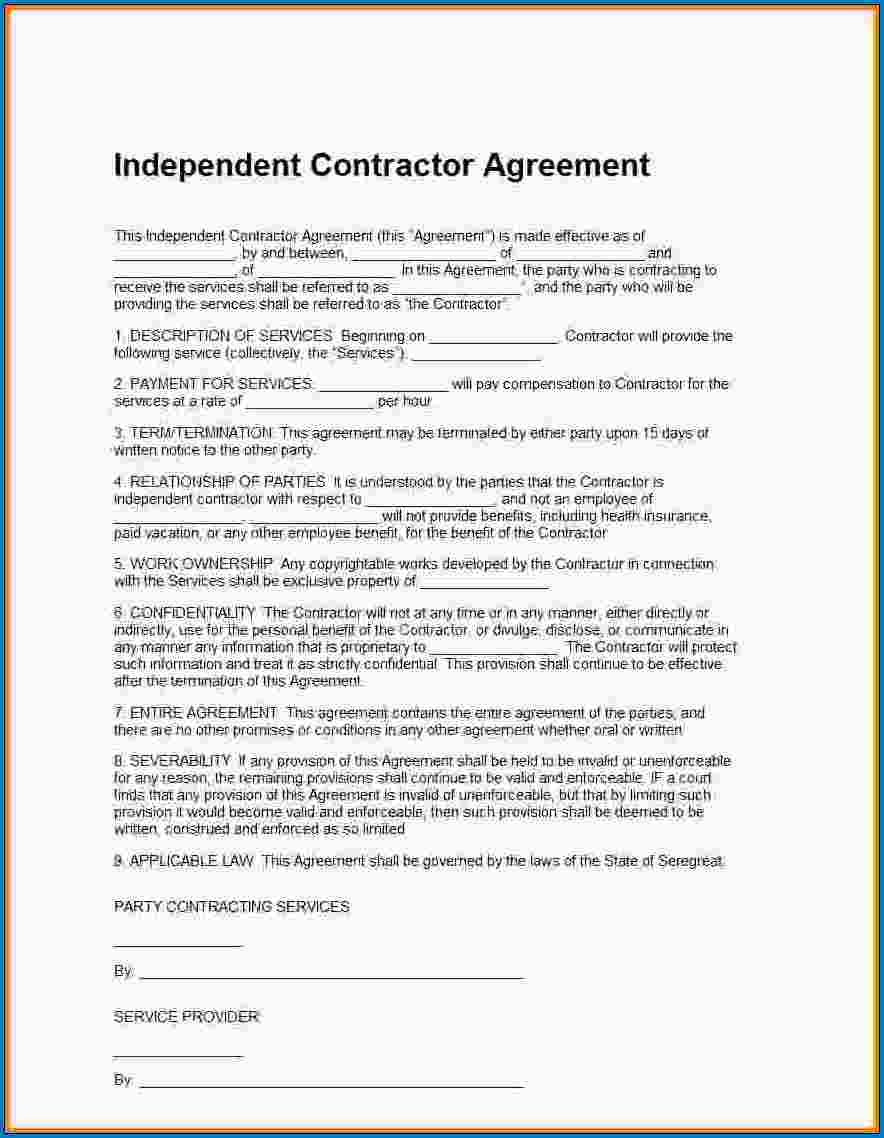

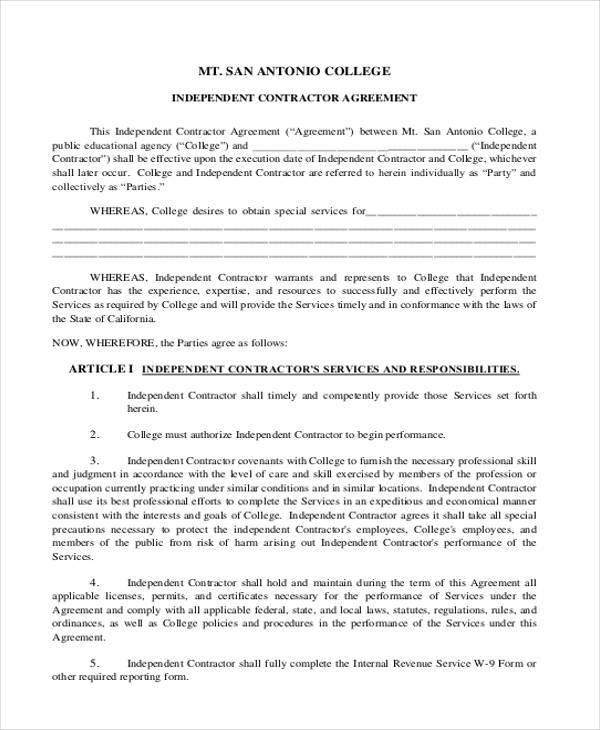

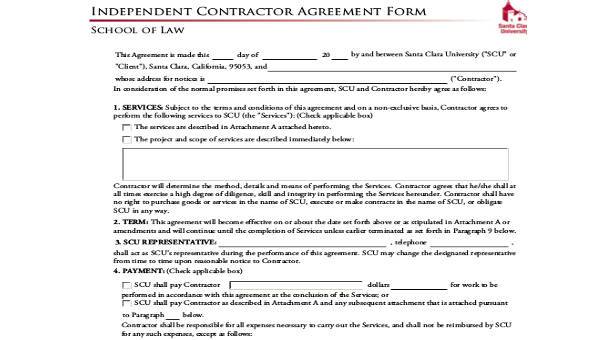

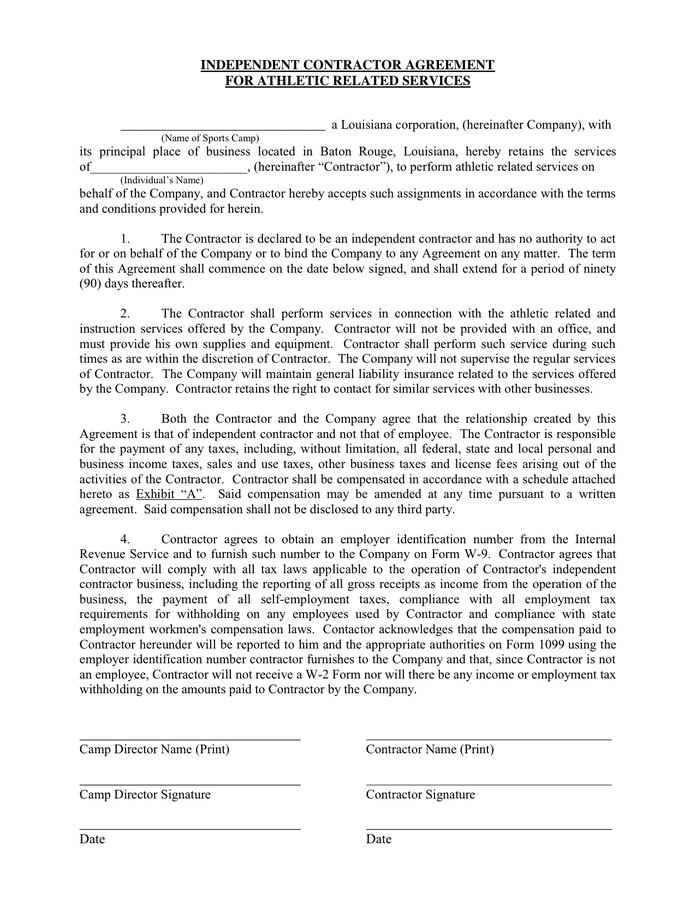

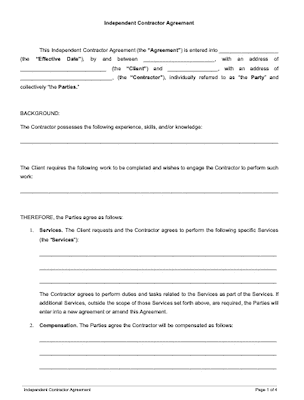

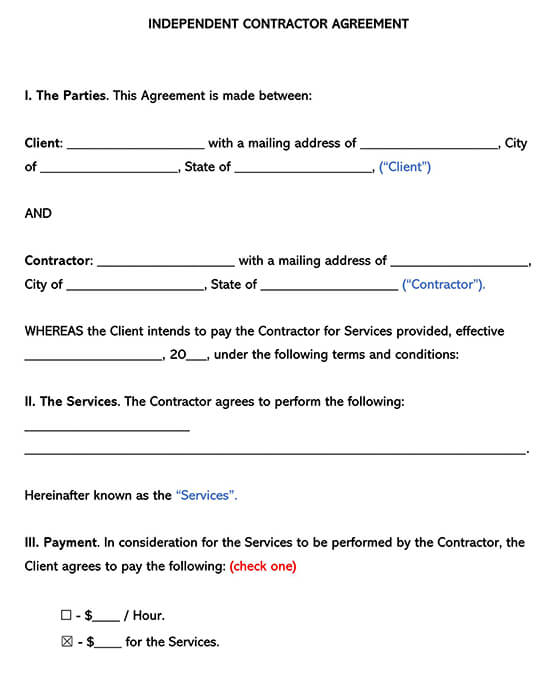

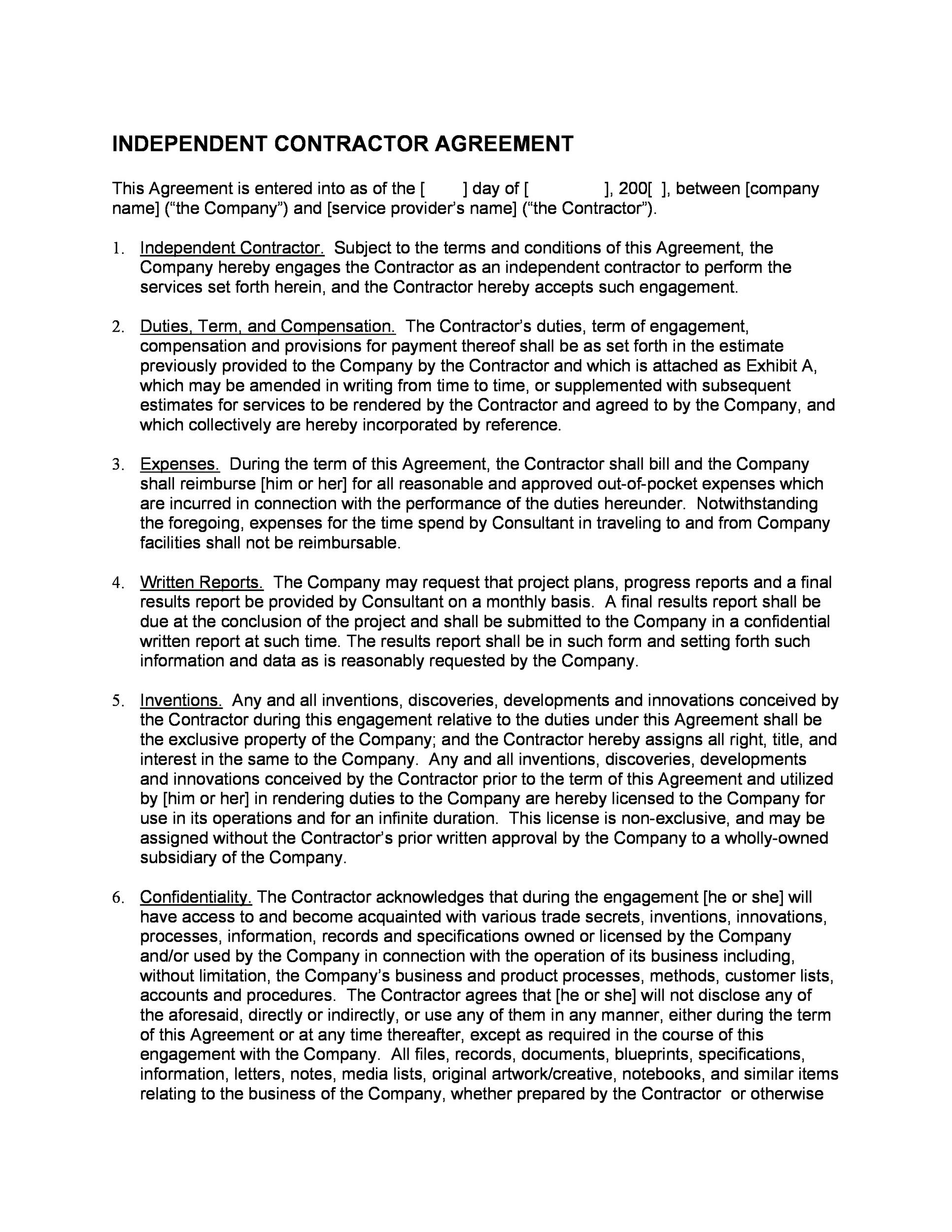

How do you 1099 an independent contractor-So we've gathered together a few of the best free sample independent contractor agreements for independent contractors They'll help you outline the job requirements and payment terms, and they're available in widelyaccepted formats like Microsoft Word or Google Docs A thorough independent contractor agreement sample from legaltemplatesnetApr 15, 21 · The independent contractor must also have sufficient time to carefully review the content you have provided in Articles I to XXIV If this document is an accurate representation of the independent contractor`s intentions, he or she should consolidate the agreement by signing the "Contractant`s Signature" line

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

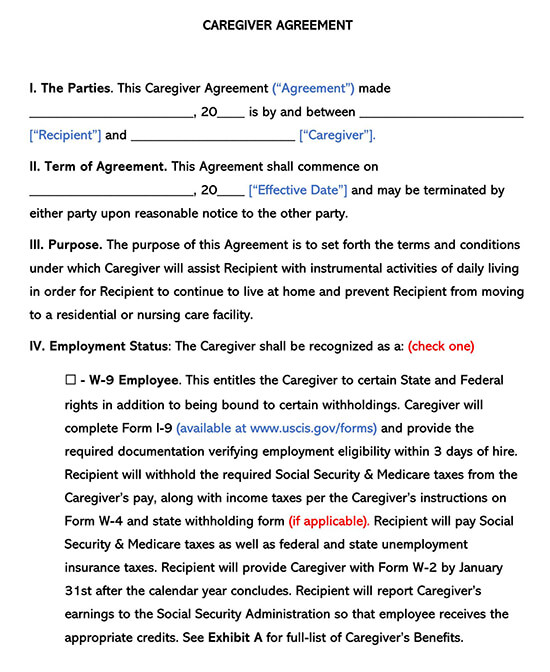

Department of Market Street Talent's client for which Independent Contractor is performing consulting services ("Client") Independent Contractors can raise concerns and make reports without fear of reprisal Any Independent Contractor on engagement at Market Street's Client1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax returnThe employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's workIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, Agreement Independent Contractor agrees that customers of the Company shall include, but are not limited to the following

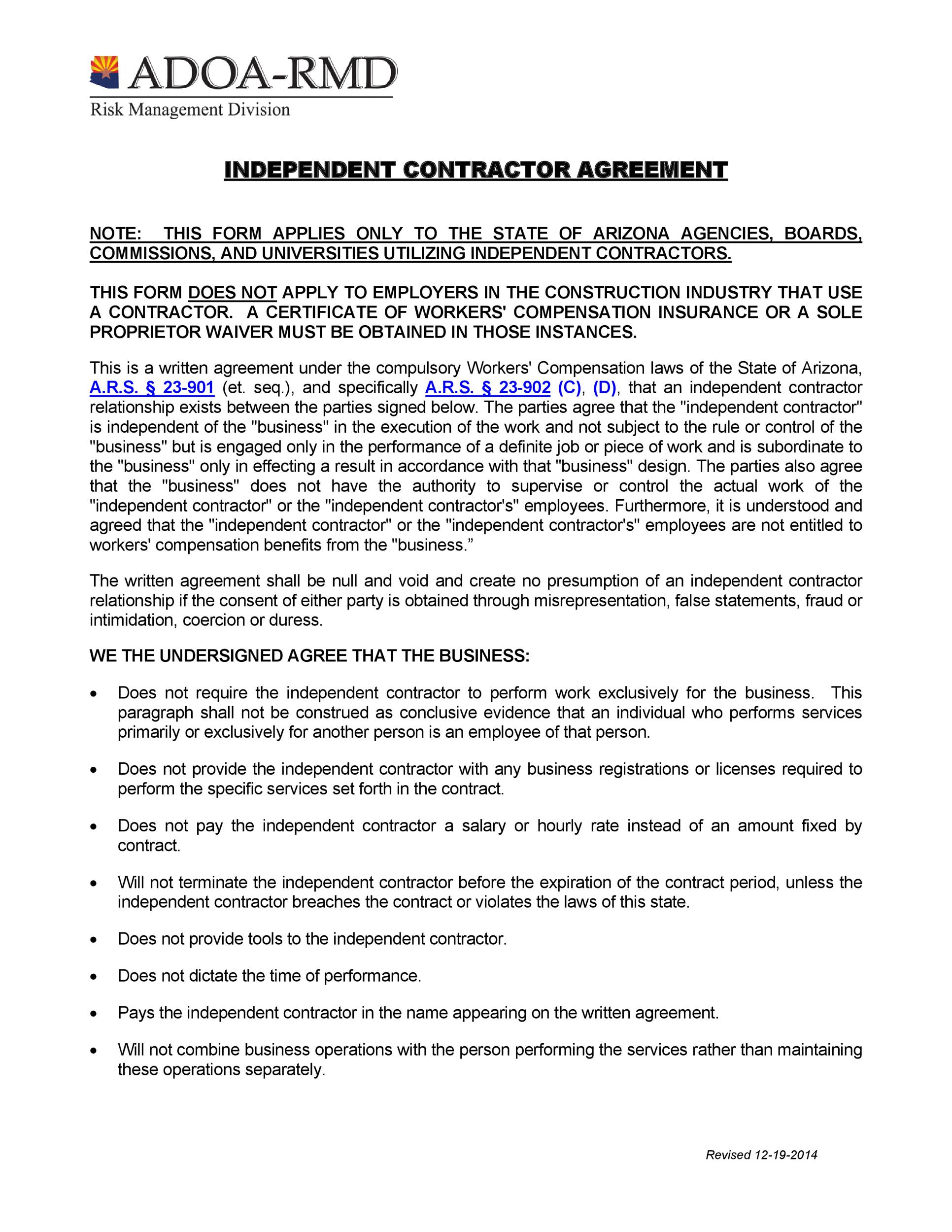

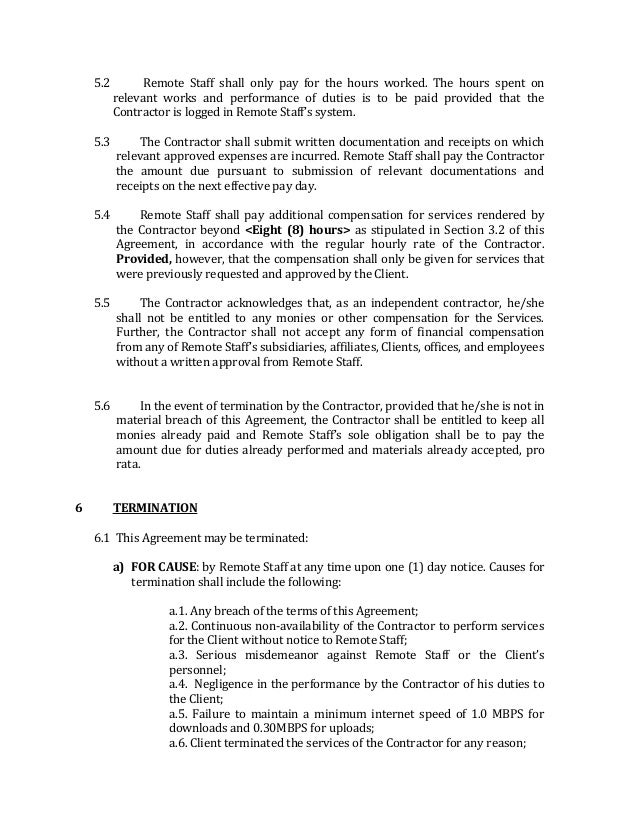

CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated services CONTRACTOR shall be an independent contractor and shall be solely responsible for payment of all taxes and/or insurance as required by federal and state law 2 PERIOD OF PERFORMANCE Either party may terminate this agreement upon notice to the otherThe worker does not have the option of choosing independent contractor status, nor will a signed contract or agreement convey independent contractor status if the common law factors indicate otherwise Misclassification can result in employer liability for state and federal tax withholding, social security and Medicare withholding, stateContractor enters into this Agreement as, and shall continue to be, an independent contractor All Services shall be performed only by Contractor and Contractor's employees Under no circumstances shall Contractor, or any of Contractor's employees, look to Company as his/her employer, or as a partner, agent or principal

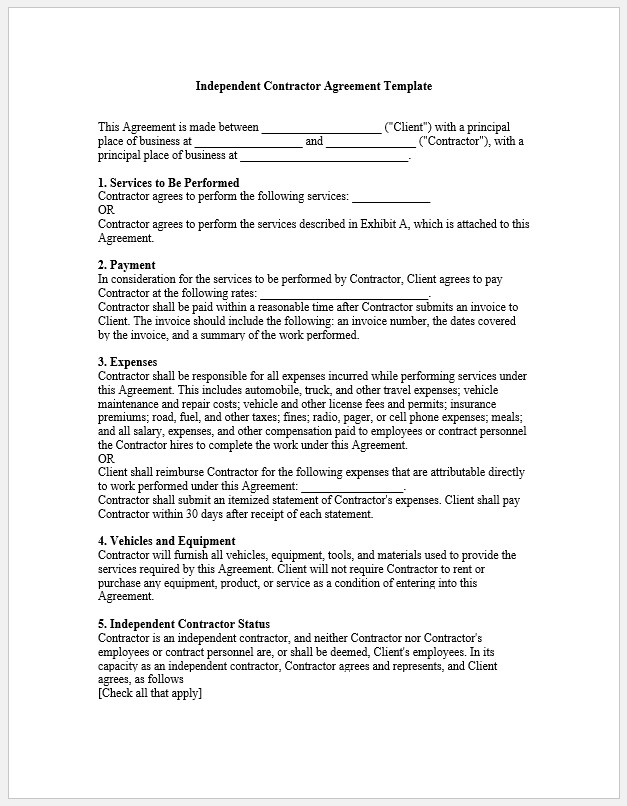

Mar 16, 21 · Also, refer to Publication 1779, Independent Contractor or Employee PDF If you would like the IRS to determine whether services are performed as an employee or independent contractor, you may submit Form SS8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax WithholdingMay 24, 21 · The 1099NEC is used by companies that hire independent contractors The hiring business will fill out and send this form in, and they should also send you a copy 1099s Are a Specialty of Ours eFile360 is the tax expert you can trust with all your 1099, 1098, and ACA efiling Are you an independent contractor looking for help filing your taxes?Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows (check all that apply)

Free Printable Independent Contractor Agreement Template Templateral

Sample Independent Contractor Agreement Independent Contractor Mediation

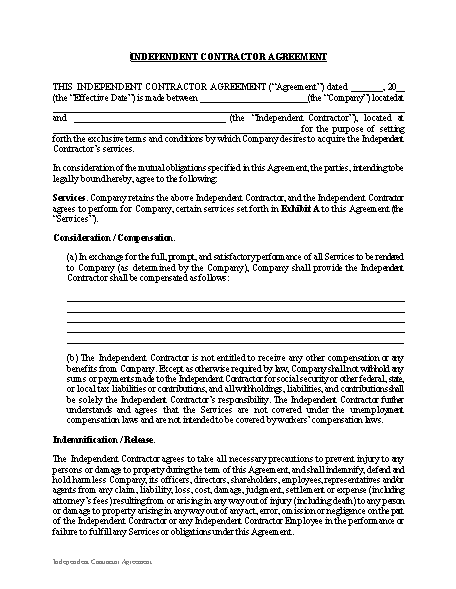

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Massachusetts Corporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and independent contractor No employer/employee relationship is created, and neither party is authorized to bind the other in any way ContractorDownload a sample template of an independent contractor agreement The document below is a sample template of an independent contractor agreement It is designed for startups to download and use Download the Sample Independent Contractor Agreement Read next Hiring as a startup Employee or independent contractor?The Independent Contractor that Contractor considers materially harmful to the Practice No notice is required if this agreement is terminated for cause Independent Contractor agrees to immediately notify Contractor in the event Independent Contractor's license to practice psychology, therapy, or

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Full Time

Independent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf ofIndependent Contractor Agreement Physician This document, created by Correct Care, Inc, is a sample of an agreement for a physician to work with a health care services provider as an independent contractor The original PDF can be found here http//wwwcorrectcareinccom/pdf/indcontpdfCompany will report all income to Independent Contractor on IRS Form 1099 Independent Contractor agrees to indemnify the Company for any claims or obligations asserted to the contrary by Independent Contractor 52 Nonexclusivity of Services Other Than to Competitors

Freelance Contract Create A Freelance Contract Form Legaltemplates

50 Free Independent Contractor Agreement Forms Templates

Jan 19, 09 · independent contractor shall be responsible for providing all tools and materials required for performance of the tasks agreed to independent contractor is responsible for payment of all federal, state and local income taxes dated _____ _____ contracting party by an authorized officer _____ independent contractor agreement for independentFurthermore, TVP agrees that during the term of this Agreement and for a period of one year following the termination or expiration of this Agreement, TVP shall not directly or indirectly solicit or attempt to solicit any customers or suppliers of The Client other than on behalf of The Client 10 Independent Contractor StatusMar 15, 21 · An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreements

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Independent Contractor Agreement Full Time

Exhibit 1011 INDEPENDENT CONTRACTOR AGREEMENT This INDEPENDENT CONTRACTOR AGREEMENT (this "Agreement") is made and entered into as of February 1, 12 (the "Effective Date"), by and between FVA Ventures, Inc, a California corporation ("ViSalus"), and Dr Michael Seidman ("Contractor")Each of ViSalus and Contractor are sometimes referred to individuallyHiring independent contractors This setup is widely spread across all company sizes Hiring contractors has multiple benefits the possibility to employ foreign workers or shortterm workers, cost per employee savings, and the ease of contractor relationships Although it's the easiest to set, it can lead to tax evasion charges and IRS audits when local laws and different setups forGet The Complete Presentation https//landingpageswebsiteleadpagesnet/agilitypresentationtophrissuesof14/Call (619) For More Information

Freelance Contract Create A Freelance Contract Form Legaltemplates

50 Free Independent Contractor Agreement Forms Templates

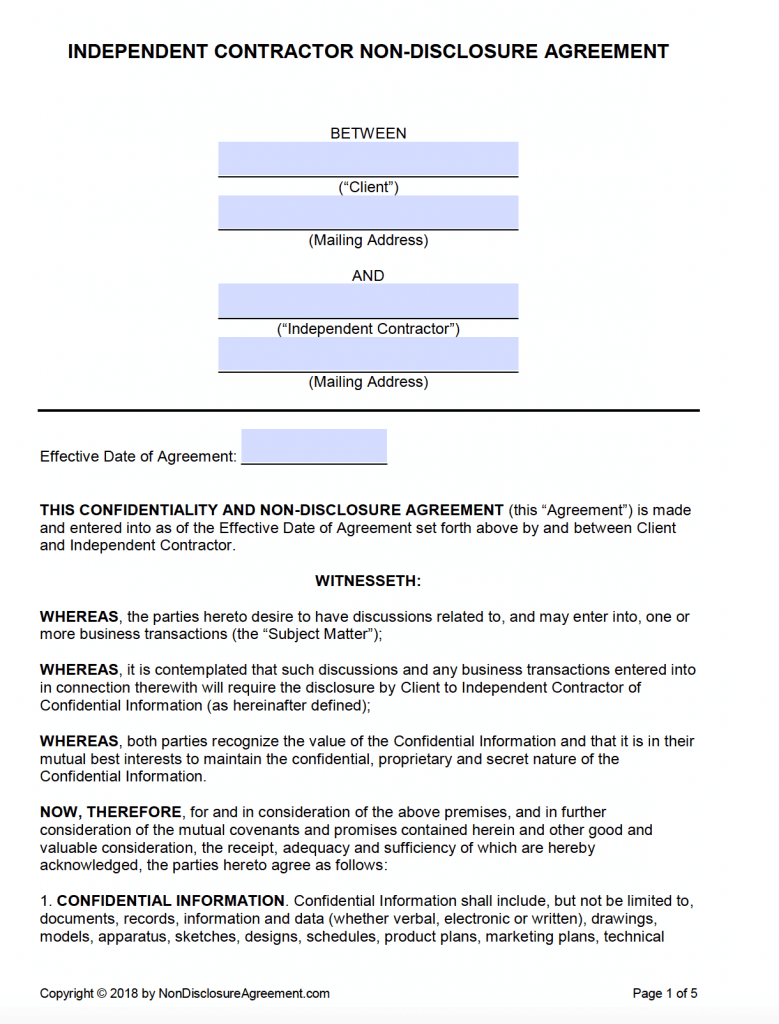

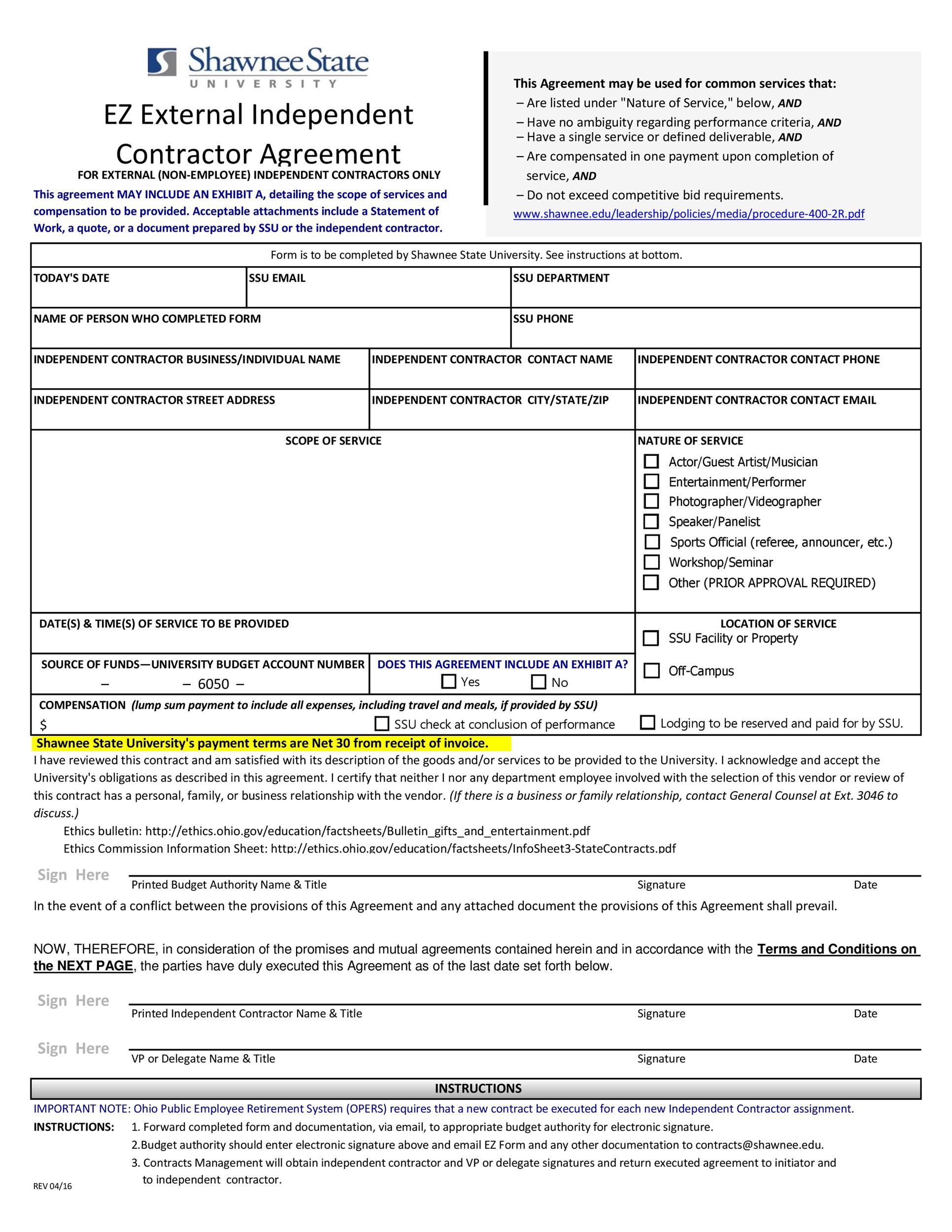

Create Document An Ohio independent contractor agreement is a contract that is used to outline the type of task (s) that a contractor is being hired to complete and how much they will be paid by the client The contract should clearly state the amount and schedule of payment (s) that the contractor will receive in addition to any expenses that the client may be required to coverContracts Independent Contractor Agreement The Foreign Corrupt Practices Act of 1977 resulted from bribery of foreign government officials by Lockheed Aircraft Company This Act is designed to prevent the bribing of foreign officials in orderB Independent Contractor hereby acknowledges and understands the term "Trade Secret(s)" includes, but is not limited to (i) a confidential, proprietary and sensitive formula, pattern, compilation, program, device, method, technique, or process, provided to Independent Contractor in connection with the performance of this Agreement that is

Independent Contractor Agreement Template Word Pdf Download Tracktime24

Free Independent Contractor Agreement Template What To Avoid

Mar 16, 21 · Also, refer to Publication 1779, Independent Contractor or Employee PDF If you would like the IRS to determine whether services are performed as an employee or independent contractor, you may submit Form SS8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax WithholdingSample independent contractor agreements are available online Using an independent contractor agreement template will save you time over creating an agreement from scratch If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to reportIt may be terminated by the Corporation with cause – defined as (1) the failure of the Contractor to act in furtherance of the interests of the Corporation and its clients, (2) a material violation by the Contractor of any provision of this Agreement, (3) the conviction of the Contractor of a crime, or (4) an act or omission which in the sole

Independent Contractor Form Template Awesome Independent Contractor Resume Sample New 1099 Form Day Planner Template Letter Templates Lettering

Independent Contractor Agreement Template Free Pdf Sample Formswift

Independent Contractor Agreement DeMarseCo Holdings Inc and Daniel H Smith (Oct 30, 06) Independent Contractor Agreement RedEnvelope Inc and John Roberts (Jun 1, 05) Independent Contractor Agreement Western Brands LLC and Ronald Snyder (Oct 1, 03) Independent Contractor Agreement CytRx Corp and Louis J Ignarro (Jul 17, 03)Independent Contractor Status The parties acknowledge that Contractor is and shall at all times be an independent contractor and not an employee of the Companies The parties agree a The Companies shall have no right to direct the manner in which Contractor performs the Services;Order and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performance

Independent Contractor Agreement Template Contract The Legal Paige

50 Free Independent Contractor Agreement Forms Templates

Because Consultant is not an employee of the Company, but rather an independent contractor, the Company shall issue an IRS Form 1099 Consultant agrees to report all compensation received under this Agreement to the appropriate federal , state or local taxing authoritiesEmail Word (2695 KB) The independent contractor nondisclosure agreementis intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state lawsJul 08, · Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis

Independent Contractor Agreement Template Get Free Sample

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

Any customer as a house account, without the Representative's agreement 6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood thatJul 07, · The contract with the independent sales rep is the best way to show that the person is an independent contractor The document should state that the sales rep is a contractor and spell out what he or she does, how often and how much he or she is paid, and provide a definition of how commission is paid out, such as getting 15 percent of each sale1099 Independent Contractor Agreement Sample The following document is an example of an independent contractual agreement It is designed for startups for download and use If you are an independent, it can help you get paid, you should end up with a payment disagreement

Independent Contractor Agreement Florida Fill Online Printable Fillable Blank Pdffiller

Independent Contractor Agreement Template Contract The Legal Paige

Jan 19, 09 · independent contractor shall be responsible for providing all tools and materials required for performance of the tasks agreed to independent contractor is responsible for payment of all federal, state and local income taxes dated _____ _____ contracting party by an authorized officer _____ independent contractor agreement for independentMay 29, 21 · > 1099 Form For Independent Contractors 19 1099 Form For Independent Contractors 19 May 29, 21 by Donatien Desrosiers 21 Posts Related to 1099 Form For Independent Contractors 19 1099 Form For Independent Contractors 1099 Form For Independent Contractors 18Jun 04, 18 · Any individuals or entities who have paid the independent contractor more than six hundred dollars ($600) within a tax year are required to file Form 1099 which details the transaction, as well as both individuals' taxpayer information

Free Florida Independent Contractor Agreement Pdf Word

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesINDEPENDENT CONTRACTOR AGREEMENT SALES AGENT This Agreement entered into on the ____ day of _____, ___, between Doctor Backup, LLC (hereinafter referred to as "the Company") and _____ (hereinafter referred to as "the Agent") shall remain in effect from this date until terminated by either partyContractor is an independent individual or entity It is engaged in the business of providing services to third parties of the nature described in the Scope of Work contemplated by Section 11 of this Agreement Client wishes to retain Contractor for such services on the basis set out in this Agreement 1 Services and Fees 11 Services

8 Independent Contract Templates Free Word Pdf Google Docs Apple Pages Format Download Free Premium Templates

Independent Contractor Resignation Letter Template Free Pdf Google Docs Word Template Net Resignation Letter Letter Templates Day Planner Template

Sample 2 Independent Contractor Indemnification The parties to this Agreement agree that JACC is an independent contractor and shall not, under any circumstances, be deemed an employee of the City JACC to indemnify, defend, and hold harmless the City, its officials, employees, and agents, from and against any and all loss, liability, or damage as a result ofAgreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services;

50 Free Independent Contractor Agreement Forms Templates

Sign Agreement Form Fill Out And Sign Printable Pdf Template Signnow

Free Printable Independent Contractor Agreement Template Templateral

Florida Independent Contractor Agreement 75 Main Group

Independent Contractor Contract Template The Contract Shop

Florida Independent Contractor Agreement 75 Main Group

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Florida Independent Contractor Agreement 75 Main Group

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

1099 Employee Difference Matters Hire Caregiver 1099 Employee Contract Template Insymbio

Free One 1 Page Independent Contractor Agreement Form Pdf Word Eforms

30 Sample Independent Contractor Agreement Forms Templates In Pdf Ms Word

New Truck Driver Independent Contractor Agreement Models Form Ideas

Independent Contractor Agreement Contractor Agreement Contract Contractor Contract Sample Contractor Contract Contractors Contract Template

Independent Contractor Agreement Template Proposable

50 Free Independent Contractor Agreement Forms Templates

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

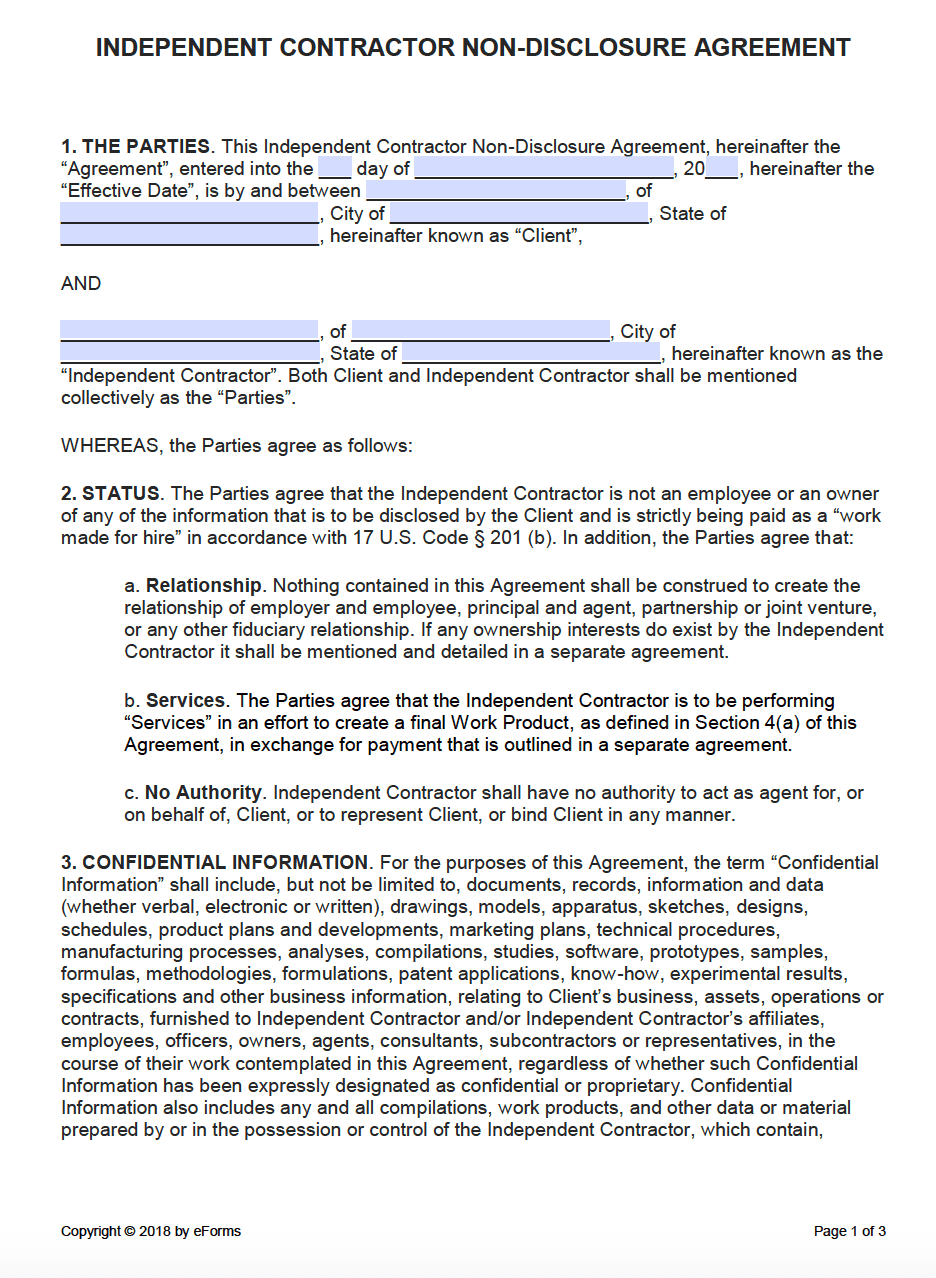

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

50 Free Independent Contractor Agreement Forms Templates

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

50 Free Independent Contractor Agreement Forms Templates

Create An Independent Contractor Agreement Download Print Pdf Word

Independent Contractor Agreement Freelance Contract Template Legalzoom Com

Independent Contractor Agreement Full Time

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Contract Letter Sample

Free Independent Contractor Agreement Templates Word Pdf

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Independent Contractor Agreement Pdf Word

Independent Contractor Agreements Print Paper Templates

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Free To Print Save Download

30 Sample Independent Contractor Agreement Forms Templates In Pdf Ms Word

Sample Independent Contractor Driver Agreement Pdf Rental Agreement Templates Independent Contractor Contract Agreement

Sample Real Estate Independent Contractor Agreement Brilliant 1099 Contractor Agreement Form Models Form Ideas

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Consultant Independent Contractor Agreements Legal Books Nolo

Tour Operator Contract Template Tourism Company And Tourism Information Center

50 Free Independent Contractor Agreement Forms Templates

New Truck Driver Independent Contractor Agreement Models Form Ideas

Free Independent Contractor Agreement Template 75 Main Group

Independent Contractor Agreement Full Time

50 Free Independent Contractor Agreement Forms Templates

Free Printable Independent Contractor Agreement Template Templateral

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Independent Contractor Agreement In Word And Pdf Formats

Free 22 Sample Independent Contractor Agreement Templates In Google Docs Ms Word Apple Pages Pdf

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

How To Write An Independent Contractor Agreement Mbo Partners

What Is A 1099 Contractor With Pictures

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Free Download Docsketch

50 Free Independent Contractor Agreement Forms Templates

Free Texas Independent Contractor Agreement Pdf Word

8 Printable Independent Contractor Agreement Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Independent Contractor Agreement Templates Word Pdf

Independent Contractor Agreement Full Time

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Printable Independent Contractor Agreement Template Templateral

Free One 1 Page Independent Contractor Agreement Form Pdf Word Eforms

Free 10 Sample Independent Contractor Agreement Templates In Ms Word Pdf Google Docs Apple Pages

Free Washington Independent Contractor Agreement Word Pdf Eforms

Independent Contractor Agreement Template Approveme Free Contract Templates

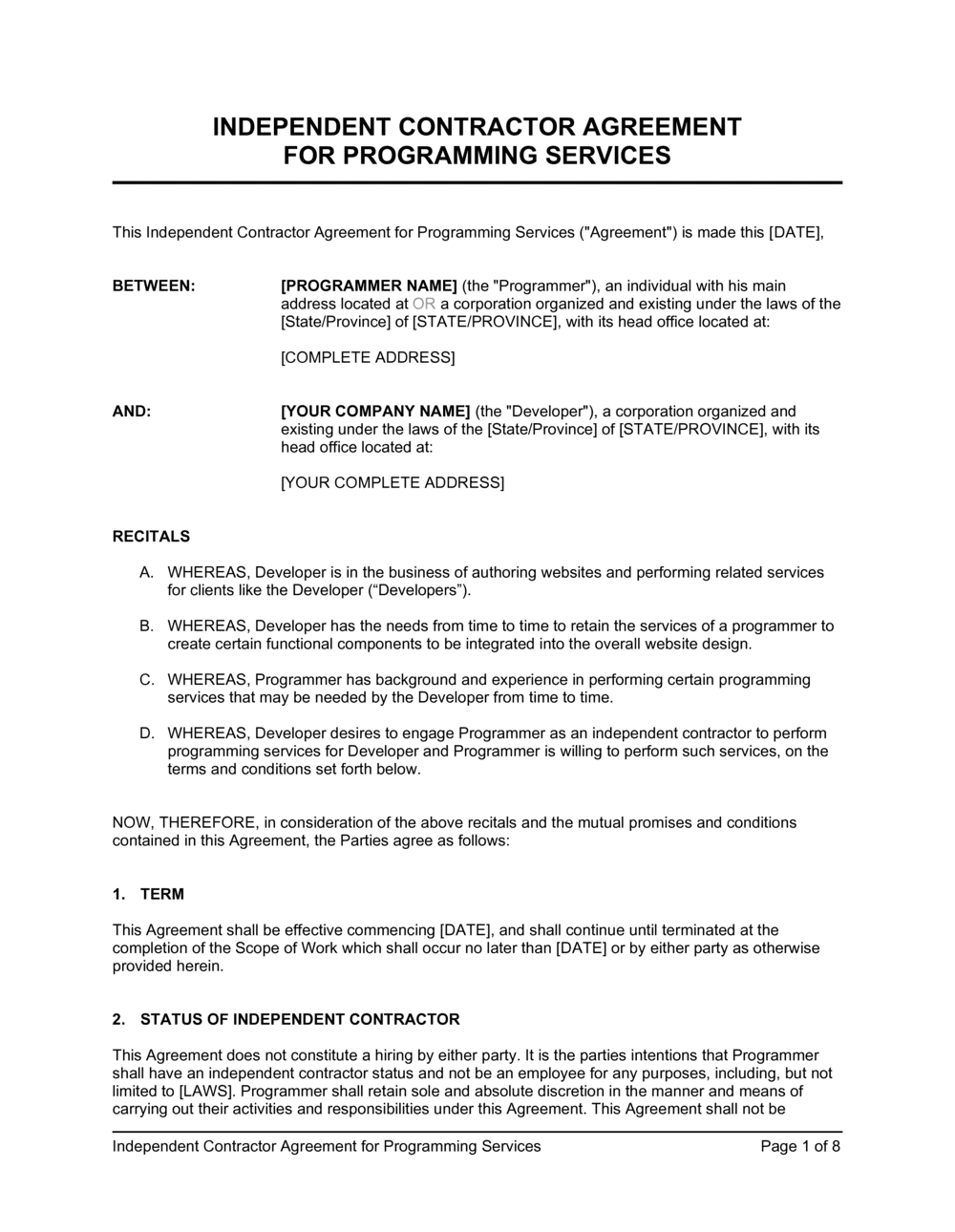

Independent Contractor Agreement For Programming Services Template By Business In A Box

Free Independent Contractor Agreement Template Download Wise

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Templates Word Pdf

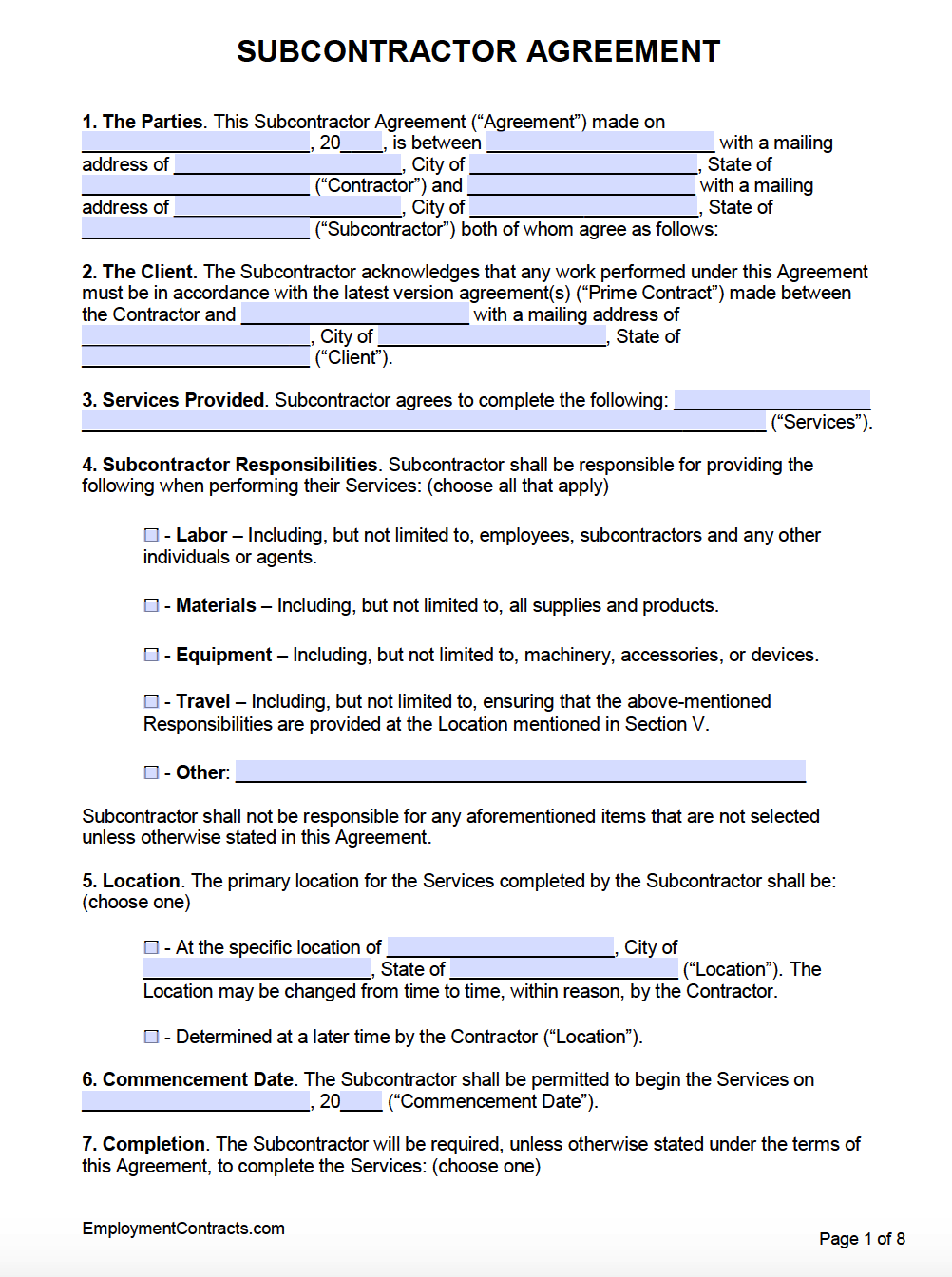

Free Subcontractor Agreement Template Pdf Word

Free Independent Contractor Agreement Templates Pdf Word Eforms

Free Printable Independent Contractor Agreement Template Templateral

0 件のコメント:

コメントを投稿